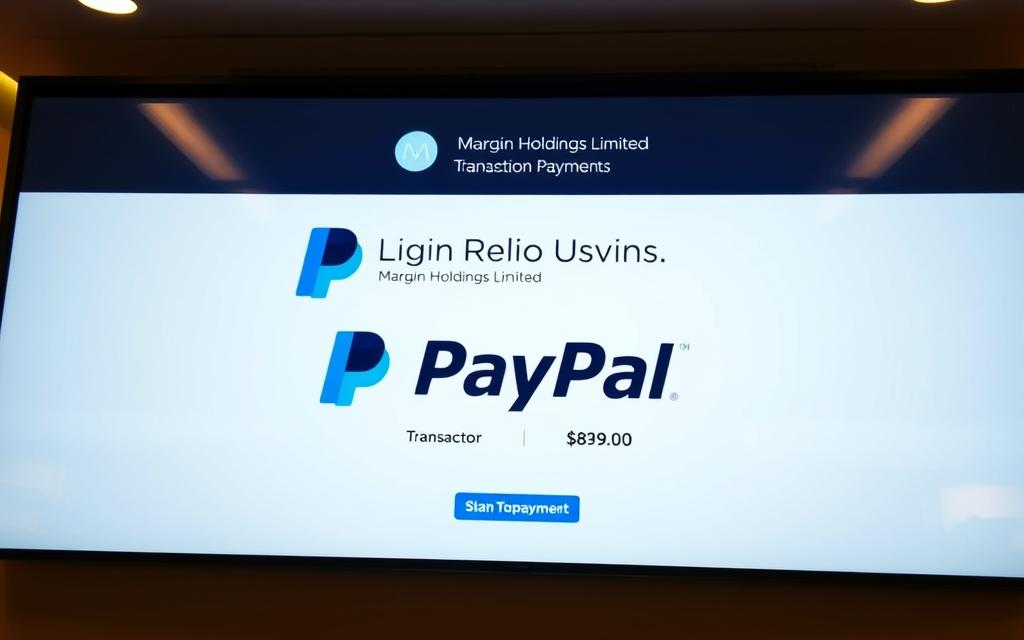

Have you noticed a mysterious charge from Margin Holdings Limited on your PayPal statement? You’re not alone. Many users have reported unauthorised transactions, sparking concerns about potential fraud.

These charges often appear as recurring payments of $24.99 without the user’s consent, raising serious security questions. It’s crucial to understand the nature of these charges to protect your financial information and take appropriate action.

The issue is not isolated, with numerous PayPal users worldwide reporting unexpected charges from Margin Holdings Limited. This article aims to provide comprehensive information about the entity, its charging scheme, and the steps you can take if you’ve been affected.

What Is Margin Holdings Limited and Why Are They Charging You?

PayPal users have been taken aback by charges from Margin Holdings Limited, prompting questions about the company’s legitimacy. Margin Holdings Limited, often abbreviated as MHL, has been a source of confusion and concern for many individuals who encounter unexpected charges on their PayPal accounts.

The True Nature of Margin Holdings Limited

Margin Holdings Limited operates by exploiting the trust users have in legitimate e-commerce platforms and payment processing systems like PayPal. Victims often encounter MHL through deceptive social media advertisements that promise attractive deals or products. Upon clicking on these ads, users are redirected to websites that closely mimic legitimate online shopping platforms, tricking them into authorizing recurring payments.

It’s crucial to understand that MHL utilizes pre-authorized payments to secure recurring charges, even if the initial payment method fails. This practice allows them to maintain a billing relationship with the user without their explicit consent for each transaction.

Common Charge Amounts and Patterns

The charges imposed by Margin Holdings Limited can vary significantly, but they often follow a pattern. Users may notice recurring charges that range from small amounts to substantial figures, depending on the nature of the transaction they were tricked into authorizing. These charges typically appear after users interact with deceptive advertisements or websites designed to capture payment information.

Why These Charges Appear on Your PayPal Account

Margin Holdings Ltd exploits PayPal’s subscription and recurring payment features to establish ongoing billing relationships. Many victims in the PayPal community report that they never explicitly authorized these charges but may have unknowingly agreed to terms hidden in fine print. The company deliberately obscures the nature of the charges, making them difficult to identify immediately. As one victim noted, “

‘I had no idea what Margin Holdings Limited was until I saw the charge on my PayPal statement.’

” This sentiment is echoed by numerous users who have taken to the PayPal community forums to share their experiences and seek advice.

In conclusion, Margin Holdings Limited charges are a result of deceptive practices that exploit users’ trust in online transactions. Understanding the true nature of these charges is the first step towards protecting oneself and disputing unauthorized transactions.

How Does the Margin Holdings Limited PayPal Charge Scam Work?

Understanding the mechanics behind the Margin Holdings Limited PayPal charge scam is crucial for protecting oneself from its deceptive tactics. The scam is carefully engineered to obscure subscription details, making it incredibly challenging for victims to identify and rectify unauthorized charges.

The Deceptive Marketing Tactics

Margin Holdings Ltd employs deceptive marketing tactics to capture payment information. They use checkout processes that hide subscription terms in fine print or behind confusing language, making it difficult for users to understand what they are signing up for.

Key tactics include:

- Deceptive checkout processes that obscure subscription terms.

- Providing fake tracking numbers or order confirmations to legitimize transactions.

- Capturing payment details through forms that appear to be for single purchases but actually authorize recurring billing.

Social Media Advertisements and Fake Websites

The scammers often use social media advertisements and fake websites to reach potential victims. These advertisements are designed to appear legitimate, enticing users to provide their payment information.

Many community members have reported falling prey to such tactics, highlighting the importance of being cautious when interacting with online advertisements.

How They Access Your Payment Information

Margin Holdings Ltd exploits PayPal’s pre-authorization features, allowing them to continue charging even if the initial payment is disputed. They deliberately collect just enough personal information to process payments while remaining difficult to contact for cancellations or refunds.

To avoid falling victim to such scams, it is essential to be vigilant when providing payment information online and to regularly monitor your PayPal account for any suspicious transaction activity.

What Should You Do If You’ve Been Charged by Margin Holdings Limited?

Receiving an unexpected charge from Margin Holdings Limited can be alarming, but there are steps you can take to address the issue. If you’ve noticed a suspicious transaction on your PayPal account, it’s crucial to act swiftly to protect your financial information.

Immediate Steps to Take

Upon discovering a Margin Holdings Limited charge, the first step is to review your account activity and identify any other suspicious transactions. Check your email for any receipts or notifications related to the charge, as these may provide additional context.

If you determine that the charge is unauthorised, report it to PayPal immediately. Their customer service team can guide you through the process of disputing the charge and potentially reversing the transaction.

How to Dispute Charges with PayPal

To dispute a charge with PayPal, start by logging into your account and navigating to the relevant transaction. Click on the “Report” option and follow the prompts to detail the issue. PayPal’s resolution centre will then investigate and work towards a resolution.

It’s essential to provide as much detail as possible when reporting the issue, including any relevant dates, amounts, and descriptions of the transaction. This information will aid PayPal in their investigation.

Contacting Your Bank or Credit Card Company

If PayPal’s resolution process is unsuccessful, the next step is to contact your bank or credit card company directly to dispute the charges from Margin Holdings Ltd. Explain that the payment was unauthorised and request a chargeback under fraudulent transaction provisions.

- Provide your financial institution with all documentation collected regarding the charges.

- Mention specifically that you never received any products or services for these payments.

- Consider temporarily freezing or replacing the affected credit card to prevent further unauthorised charges.

Many financial institutions have specific fraud departments that can offer additional solution options beyond standard dispute processes. By working closely with your bank or credit card company, you can find a suitable solution to the issue.

Being a victim of fraudulent charges can be stressful, but by taking prompt action and working with your financial institution, you can mitigate the impact. The community recommends staying vigilant and taking all necessary steps to protect your financial information.

Protecting Yourself from PayPal Scams Like Margin Holdings Limited

Protecting yourself from PayPal scams requires a combination of awareness, caution, and proactive security practices. The PayPal community has developed several preventative measures based on collective experiences with these types of scams. To avoid falling victim to deceptive company tactics, it’s crucial to understand common warning signs that may lead to unauthorised charges.

Regular monitoring of your accounts is a vital solution for early detection of suspicious transaction activity. Being cautious about which websites you make purchases from can significantly reduce your risk of exposure to payment scams. It’s also essential to verify website URLs for signs of phishing or fraudulent activity.

When making online purchases, it’s vital to scrutinise the fine print and thoroughly review terms and conditions. Watch out for unclear or hidden recurring billing provisions, as these are often used by scam operations like Margin Holdings Limited. Legitimate companies make their billing practices transparent, while scam operations hide this information in dense legal content.

To further enhance your security, employ strong, unique passwords for all online accounts, and consider using a password manager. Many community members recommend using dedicated payment cards with limits for online purchases to minimise potential losses. By taking these proactive steps, you can significantly reduce your risk of being targeted by scams like Margin Holdings Limited.